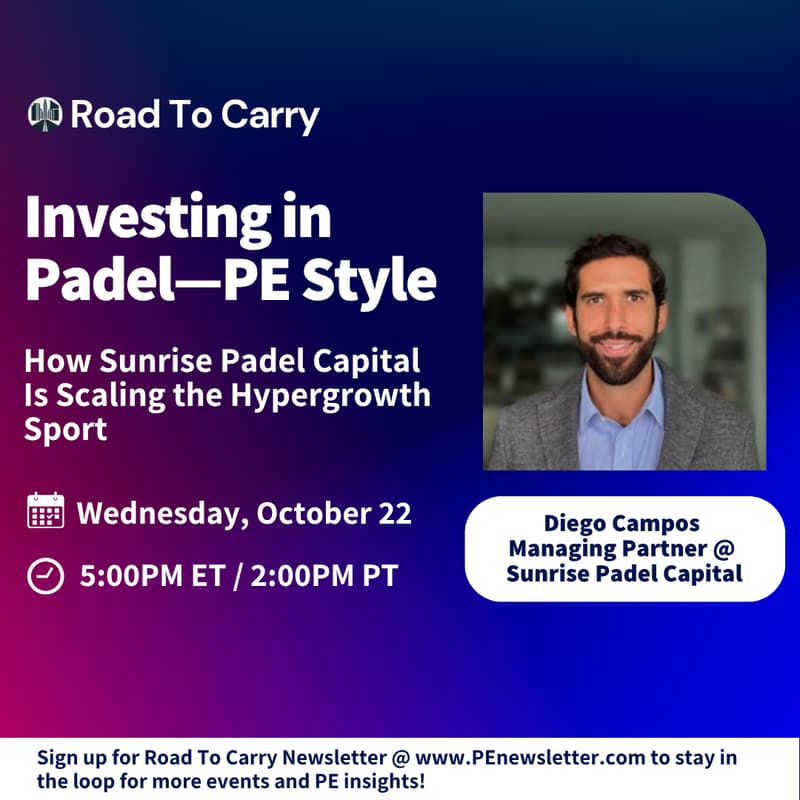

Investing in Padel—PE Style: How Sunrise Padel Capital Is Scaling the Hypergrowth Sport

Played by 30+ million people across 130 countries and supported by 40,000+ courts worldwide (of which <1,000 is in the U.S.), padel is expanding at 20–25% annually — from Europe’s booming clubs to a rapidly emerging U.S. market.

Sunrise Padel Capital is investing behind that momentum — private-equity style.

After fully deploying Fund I ($2.3M across 9 clubs) — totaling 41 padel courts and 19 pickleball courts across 7 U.S. cities — Sunrise now holds the largest padel investment footprint in the country ahead of hyperscaling the model with Fund II.

Join Diego Campos, Partner at Sunrise Padel Capital, for a 60-minute deep dive and Q&A into how investors are structuring deals in this new asset class — from club-level economics (35% EBITDA margins, ~2-year payback) to scaling playbooks and long-term market outlook.