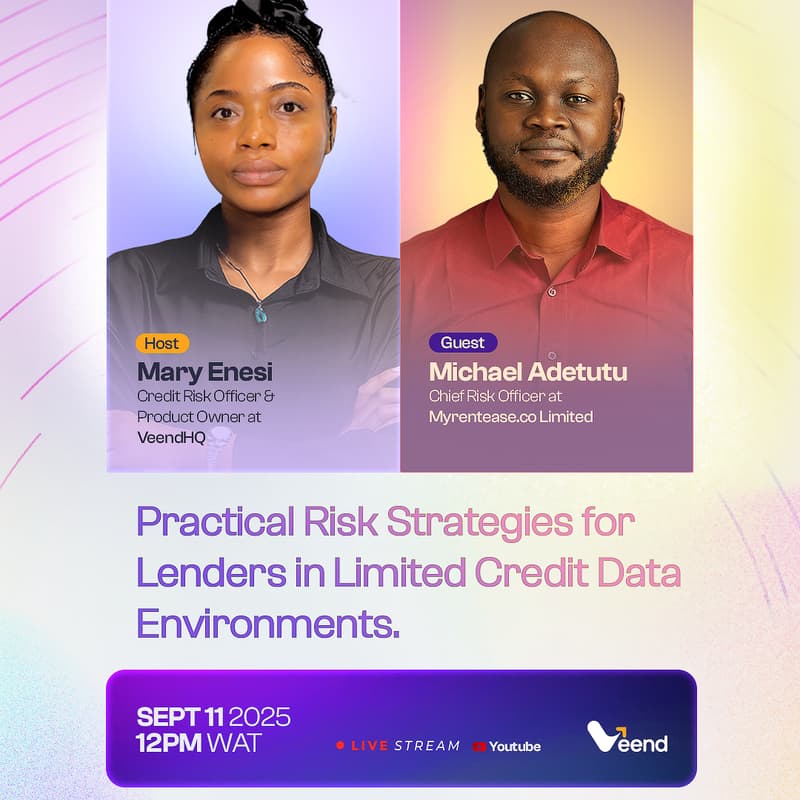

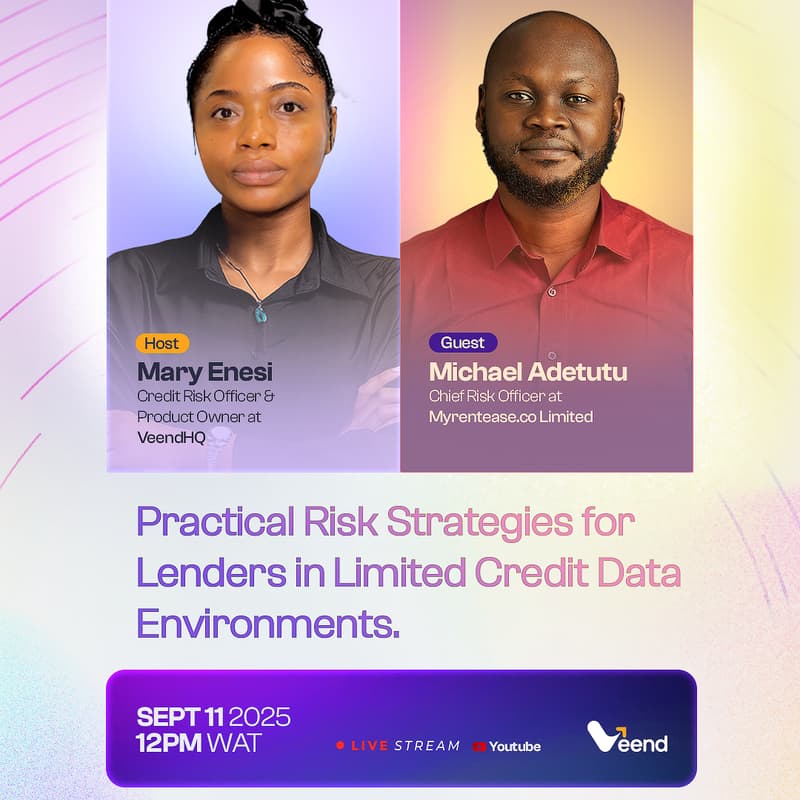

Practical Risk Strategies for Lenders in Limited Credit Data Environments

Lenders across Nigeria face a common challenge: how to accurately assess borrower risk when credit data is scarce, fragmented, or unreliable. Traditional credit scoring methods often fall short, leaving financial institutions exposed to defaults, fraud, and poor portfolio performance.

This session is designed for financial institutions, digital lenders, and credit professionals who are struggling with:

Limited or non-existent credit bureau data

High risk when lending to thin-file or first-time borrowers

Difficulty balancing loan growth with portfolio quality

Pressure to innovate without compromising risk management

✅ What you’ll gain:

By the end of this webinar, you’ll leave with actionable strategies to:

Minimize credit risk in data-poor environments

Improve operational efficiency in lending

Expand access to credit responsibly

Leverage innovation without increasing exposure

📅 Date: Thursday, 11 September 2025

⏰ Time: 12PM

📍 Location: YouTube/LinkedIn Live