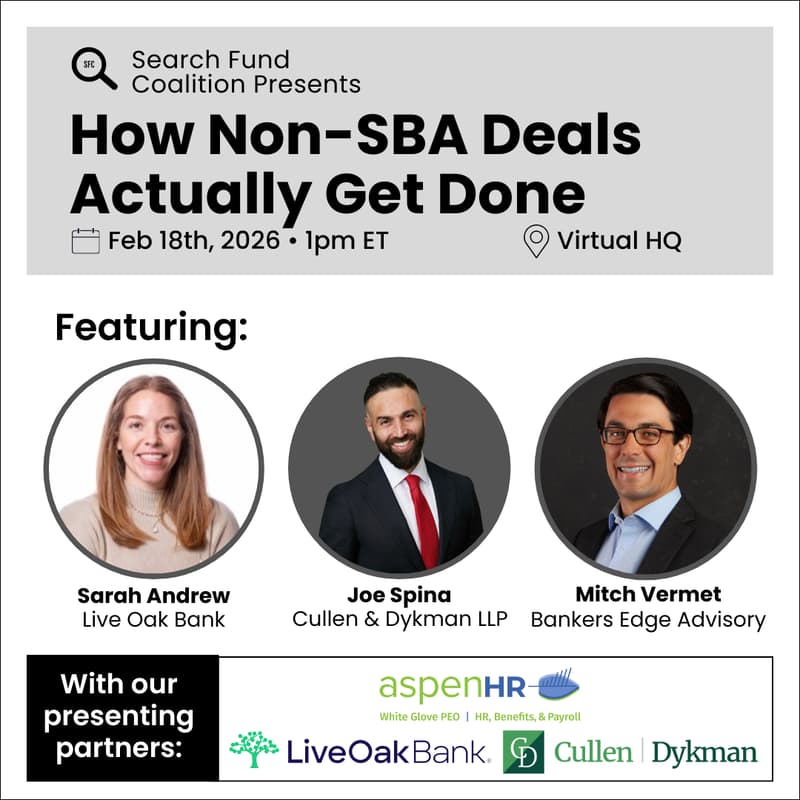

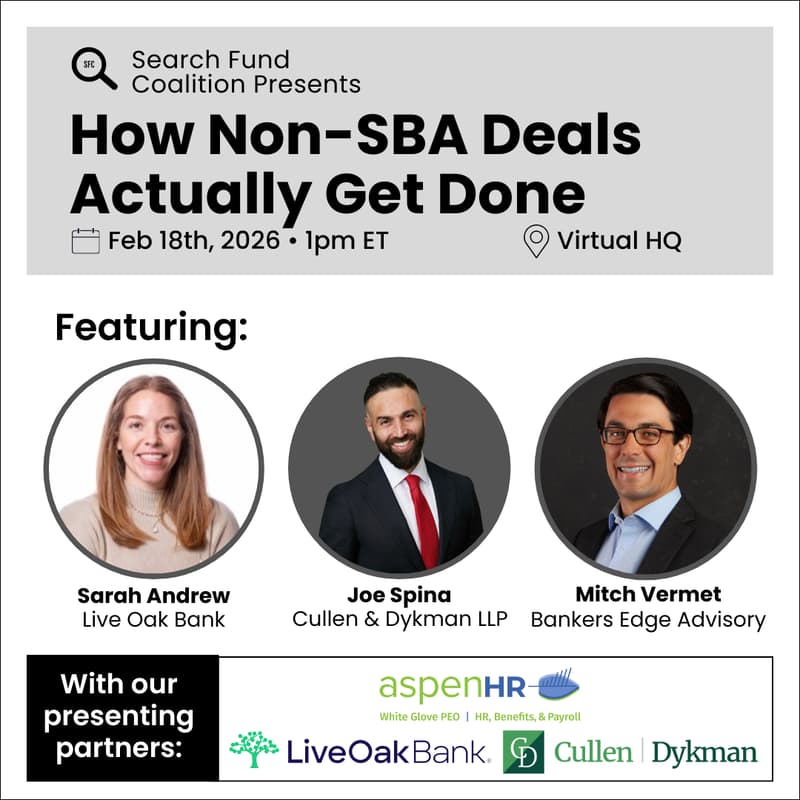

How Non-SBA Deals Actually Get Done

Doing Non-SBA Deals: What It Takes and How They Actually Get Done

Recent changes in SBA policy have narrowed who can rely on SBA financing, pushing more Searchers to seriously evaluate non-SBA acquisition paths.

This session is focused entirely on what it actually takes to do a non-SBA deal. How these deals are structured. How they are financed. Where risk shifts. And what Searchers tend to underestimate when SBA is no longer part of the capital stack.

We will walk through:

How experienced operators, investors, and advisors approach non-SBA acquisitions in practice

Common capital sources used outside of SBA

How deal terms and structures differ in non-SBA transactions

The tradeoffs Searchers should expect based on deal size, timing, and personal constraints

This conversation is designed for Searchers who cannot use SBA financing or want to broaden their acquisition playbook beyond SBA. Practical, grounded, and focused on how these deals actually get done.

Panelists include:

Sarah Andrews, Live Oak Bank

Joe Spina, Cullen & Dykman LLP

Mitch Vermet, Bankers Edge Advisory

If you are evaluating non-SBA options for your Search or expect to rely on alternative financing, this session will give you a clearer framework for how to move forward.