Alternative Paths to Funding and Building on Your Own Terms

Venture capital is not the only way to build a great company.

It’s just the loudest.

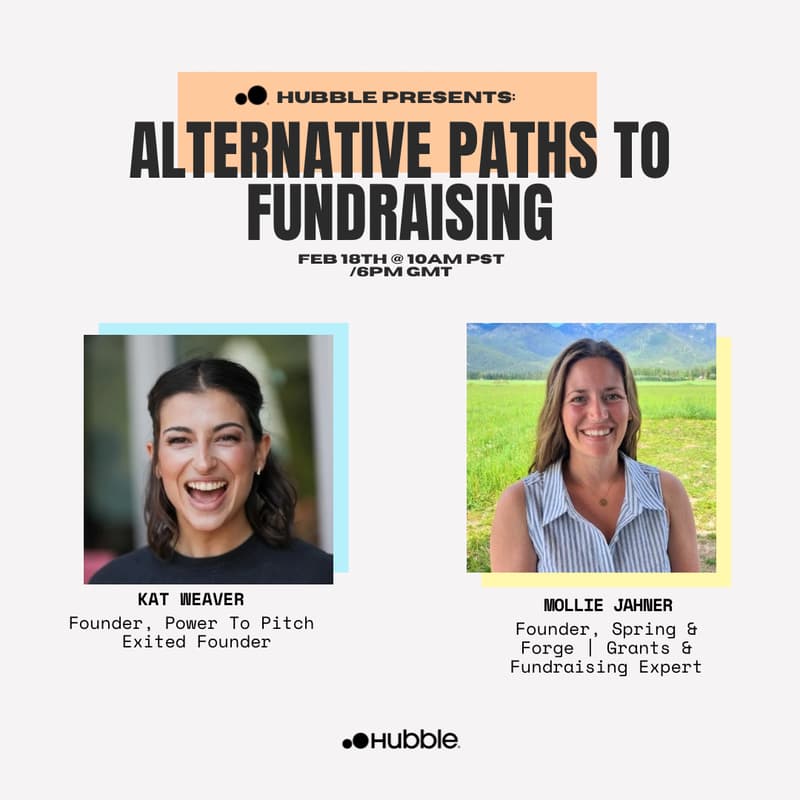

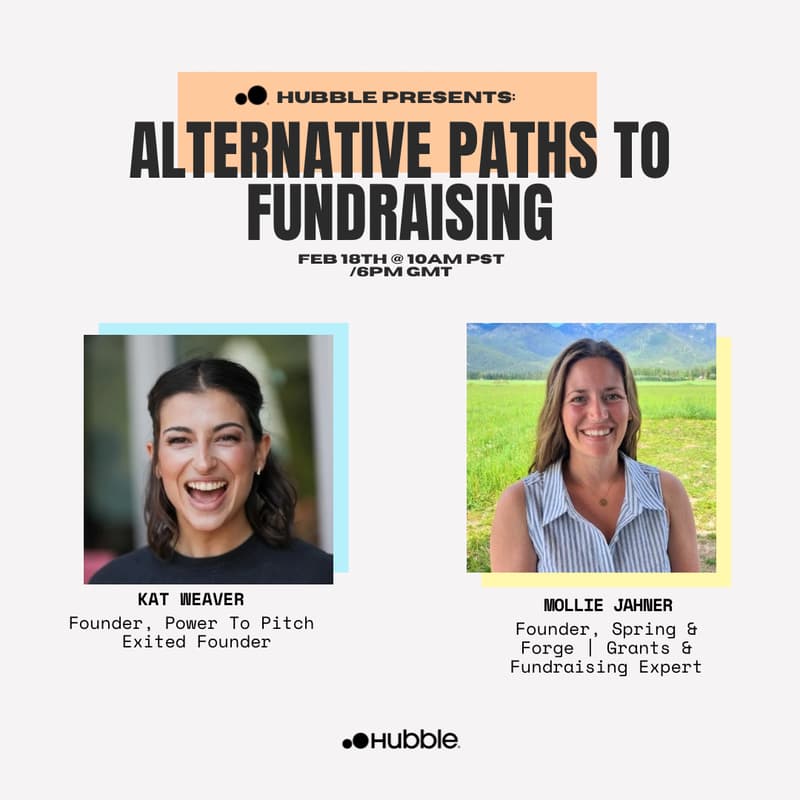

Join us for a candid conversation on alternative fundraising strategies, and how founders can finance and scale companies without defaulting to the VC path.

This session is for founders who want optionality: more control, healthier cap tables, and growth strategies aligned with how they actually want to build.

Our Experts:

Mollie Jahner: CEO at Springe-Forge | Non-Dilutive Funding | Deep Tech & Defense Ecosystems

Kat Weaver: CEO at Power to Pitch | Angel Investor & Advisor

We’ll explore:

– When VC is the right path, and when it quietly becomes the wrong one

– Bootstrapping, revenue-based financing, angel syndicates, strategic angels, and family offices

– Crowdfunding, grants, venture debt, and hybrid models most founders never hear about

– How different funding paths shape control, dilution, speed, and exit options

– What investors look for across non-traditional funding routes

This is for YOU to understand practical frameworks to help you choose a funding strategy that fits your business, not someone else’s outdated Twitter thread.

This is not an anti-VC rant.

It’s a strategy session on leverage, alignment, and building companies on your own terms.

Ideal for early-stage founders, repeat founders, operators considering spin-outs, and investors interested in more creative capital structures.