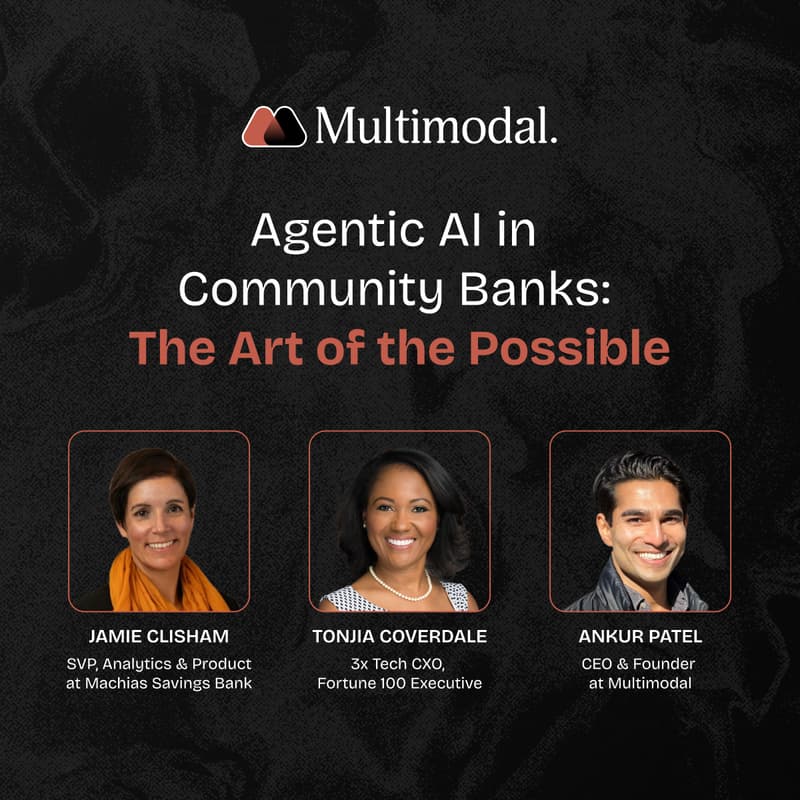

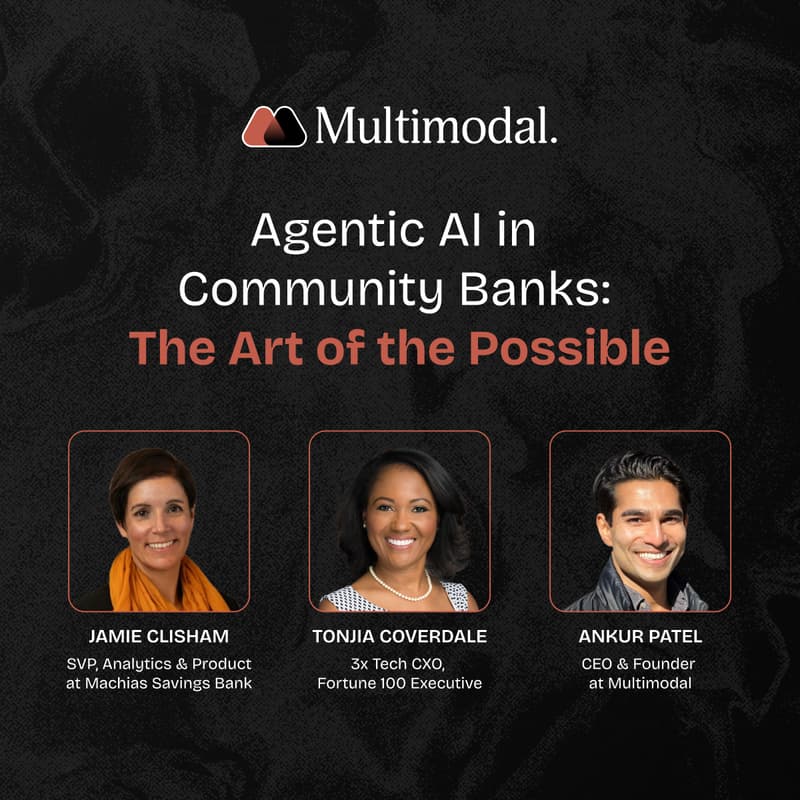

Agentic AI in Community Banking: Unlock the Art of the Possible

Wednesday, October 8 | 4:00 PM – 5:00 PM EDT | Virtual

Reserve Your Spot – Limited Seats for Community Bank Leaders

Community banks today face rising customer expectations, tighter budgets, and mounting regulatory pressure. How can lean teams deliver fast, compliant, and personalized service without adding headcount?

Join Ankur Patel, Founder & CEO of Multimodal, for a practical, results-focused webinar showing how Agentic AI transforms operations in community banks. Learn from real-world examples and gain actionable insights you can implement immediately.

What You’ll Take Away

🎯 4 High-Impact Workflow Automations

Customer Onboarding: Collect IDs, e-sign documents, open accounts, and create records in minutes

KYC/AML Compliance: Automate identity verification, sanctions screening, and alerts—fully auditable

Lending Operations: Gather documents, pull credit, build memos, and route applications to underwriting automatically

Customer Service: Triage requests, execute routine tasks, and escalate issues intelligently

🔍 Vendor Evaluation Checklist

Get a practical checklist for evaluating agentic AI vendors in regulated banking environments.

💡 Peer Insights

Hear directly from community bank leaders:

Jamie Clisham, Machias Savings Bank – workflow automation results and lessons learned

Tonjia Coverdale, ex-VP, Associated Bank & Nationwide – early adoption insights and strategic takeaways

Why This Webinar is Different

This isn’t a sales pitch—it’s peer-driven intelligence. You’ll leave with:

Concrete use cases from banks like yours

Implementation roadmaps that actually work

Evaluation criteria developed by peers in regulated banking

See how Agentic AI can cut processing time, reduce manual effort, and free your team to focus on what matters most.