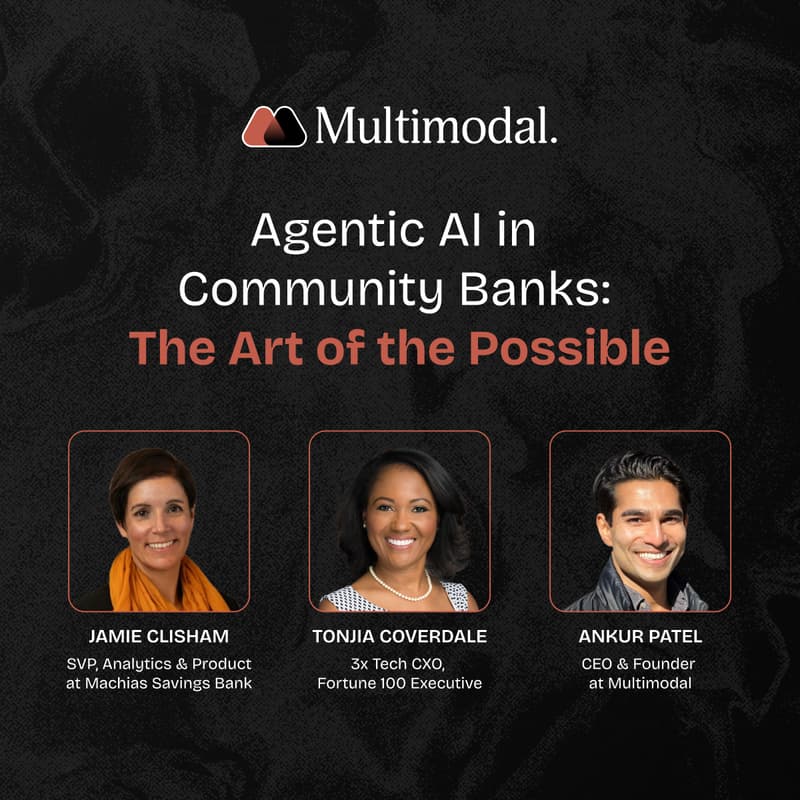

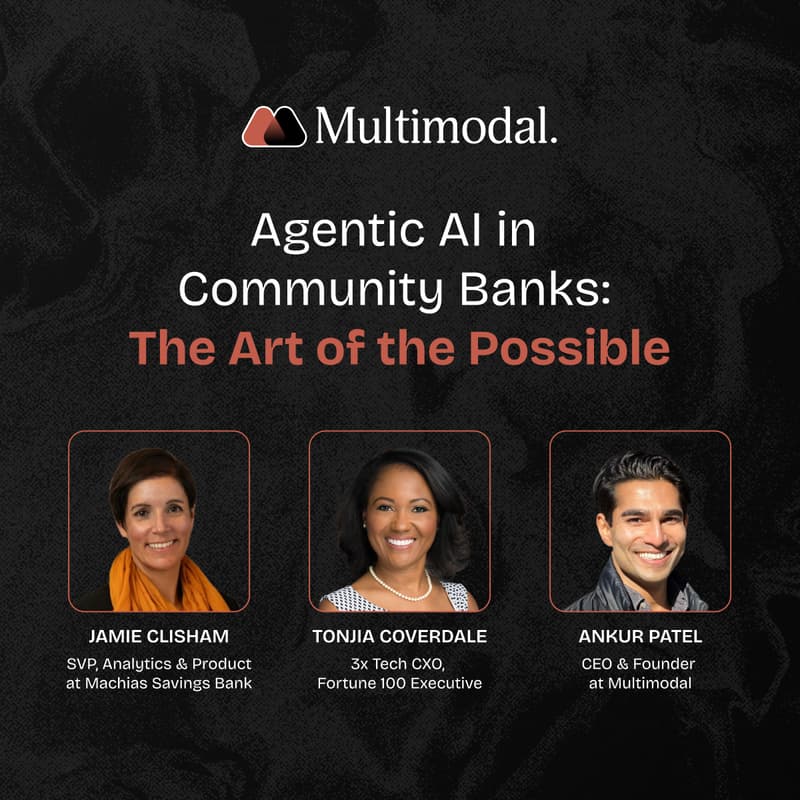

Agentic AI in Banking - The Art of the Possible

Register Now - Transform Your Operations with AI That Actually Works

Banks juggle rising customer expectations, tight budgets, and regulatory scrutiny. Agentic AI lets lean teams automate complex workflows while maintaining compliance and the personal touch customers expect.

In this webinar, hosted by Multimodal's Founder and CEO Ankur Patel, we'll discuss agentic AI use-cases for community banks and hear from industry experts.

What You'll Learn

🎯 Four High-Impact Workflow Automations

Customer Onboarding: Auto-collect IDs, e-sign documents, open accounts, create records—all in minutes

KYC/AML: Orchestrate identity verification, sanctions screening, and alert review with full audit trails

Lending: Gather documents, pull credit, build memos, route to underwriting automatically

Customer Service: Intelligently triage requests, execute routine tasks, escalate with context

🔍 Vendor Evaluation Checklist

Get the must-have capabilities checklist for evaluating agentic AI vendors in regulated environments.

💡 Peer Insights from Jamie Clisham (Machias Savings Bank) and Tonjia Coverdale (formerly of Associated Bank and Nationwide).

Hear executives share their AI initiatives, strategic outlook, and lessons learned from early implementations.

Why This Webinar Is Different

This isn't vendor marketing—it's practical intelligence from community bank leaders already seeing results. You'll get specific use cases, implementation roadmaps, and evaluation criteria developed by your peers.