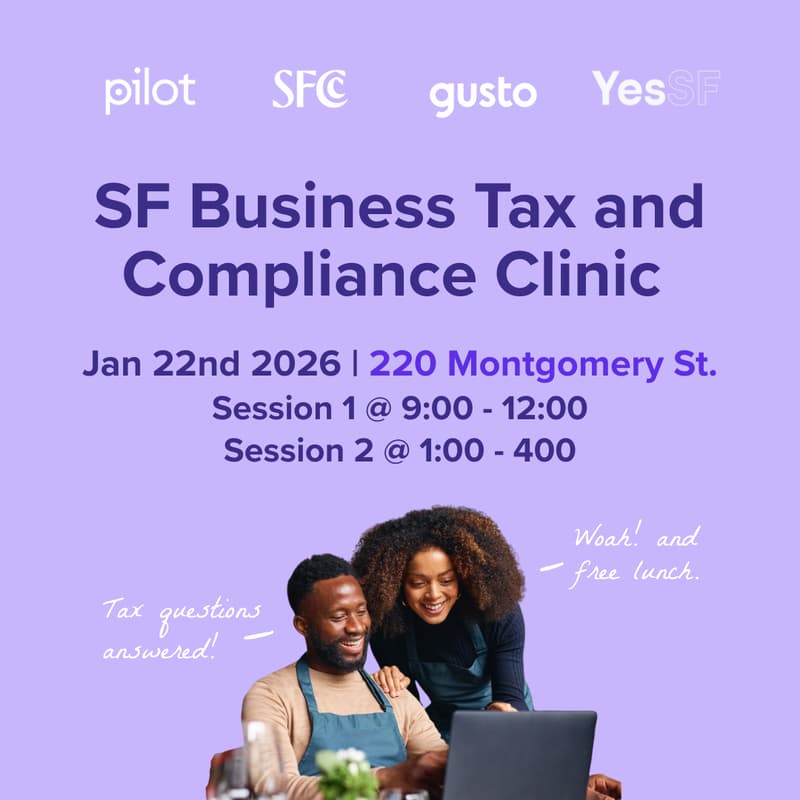

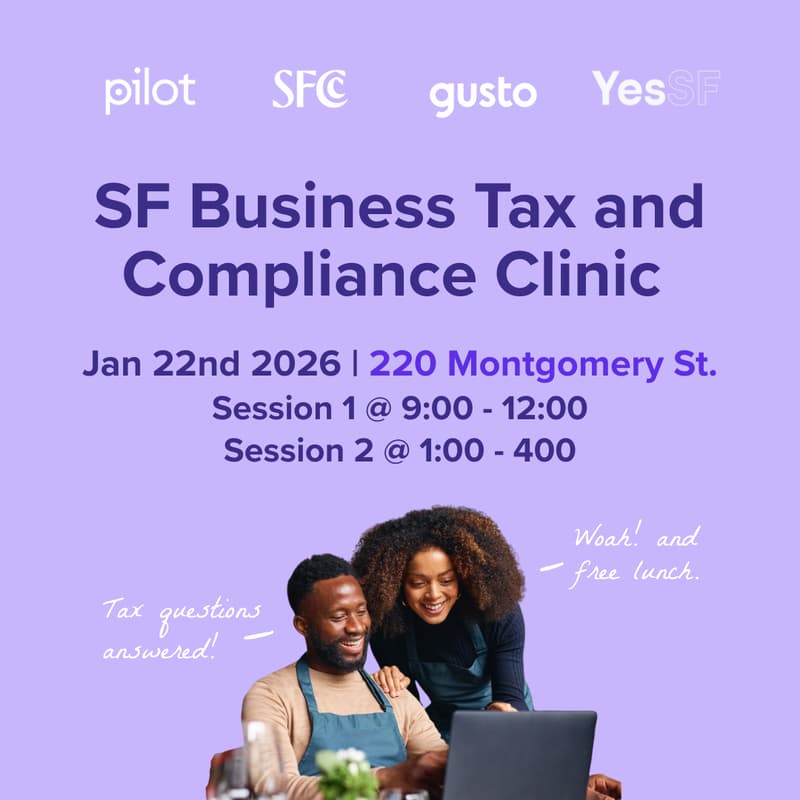

SF Business Tax & Compliance Clinic

Attend our SF Business Tax & Compliance Clinic and win a free dinner for 10 to Kokkari for you and your customers on March 3rd!

Join Pilot, the San Francisco Chamber of Commerce, Gusto, and YesSF for the SF Business Tax & Compliance Clinic, a hands-on event designed to help local business owners get fully prepared for the 2026 tax season.

We are offering two identical sessions so attendees can choose the time that works best:

Morning Session: 9:00 AM – 12:00 PM

Afternoon Session: 1:00 PM – 4:00 PM

Lunch provided (12:00–1:00 PM) for both groups.

Red Bay Coffee Bar available all day.

Expert Panels & Working Sessions

Panel 1: The 2026 San Francisco Small Business Tax Outlook

A high-level conversation with city leaders and business experts examining the 2026 tax landscape, economic outlook, policy updates, and the challenges SF small businesses should expect. Learn how changing tax frameworks impact daily operations and what proactive steps to take before tax season.

Panel 2: Practical Tax Strategies for San Francisco Businesses

A tactical, action-focused session covering the most commonly missed deductions, bookkeeping habits that reduce audit risk, entity structure considerations, quarterly tax planning, and industry-specific pitfalls.

Experts also discuss compliance, financing, workforce decisions, and essential city filings—turning tax complexity into clear next steps.

Small Business Tax Clinic: Hands-On Help & 1:1 Consultations

A high-impact breakout session offering personalized guidance across:

Federal, state & local tax obligations

SF filings & deadlines

Sales tax, payroll tax & workforce compliance

Entity structure questions

Bookkeeping best practices

Financing, grants & business planning

Overall business operations support

Meet directly with Pilot tax specialists, Gusto Compliance specialists, SBDC advisors, local accounting partners.

Walk away with a customized 2026 readiness plan: checklists, timelines, and compliance reminders tailored to your business.

Featured Speakers & Experts

Ted Egan, Chief Economist, City of San Francisco

Jessica Qian Wan, Director, San Francisco Small Business Development Center (SBDC)

David Kupferman, CPA & Tax Expert

Doug Bend, Bend Law Group

Amanda Fried, Chief of Policy & Communications, SF Treasurer & Tax Collector

Jessica McKellar, CEO & Co-Founder, Pilot

Adam Fooksa, Retirement Expert, Gusto

Dorenda Haynes, Accounting Advisor, SF SBDC

Gabriela Sapp, Certified Capital Advisor, SF SBDC

Sarah Weaver, Partner, BPM LLP

And more…

Why Attend?

Whether you need big-picture clarity or specific, actionable guidance, this clinic provides the expert insight, tools, and support you need to stay compliant and financially confident heading into 2026.

Everything we’ll be sharing in the session is general information — it’s not tax, legal, or financial advice. Your situation is unique, so be sure to check in with your own tax professional for guidance. Pilot and its team aren’t responsible for any decisions you make (or don’t make) based on this session.