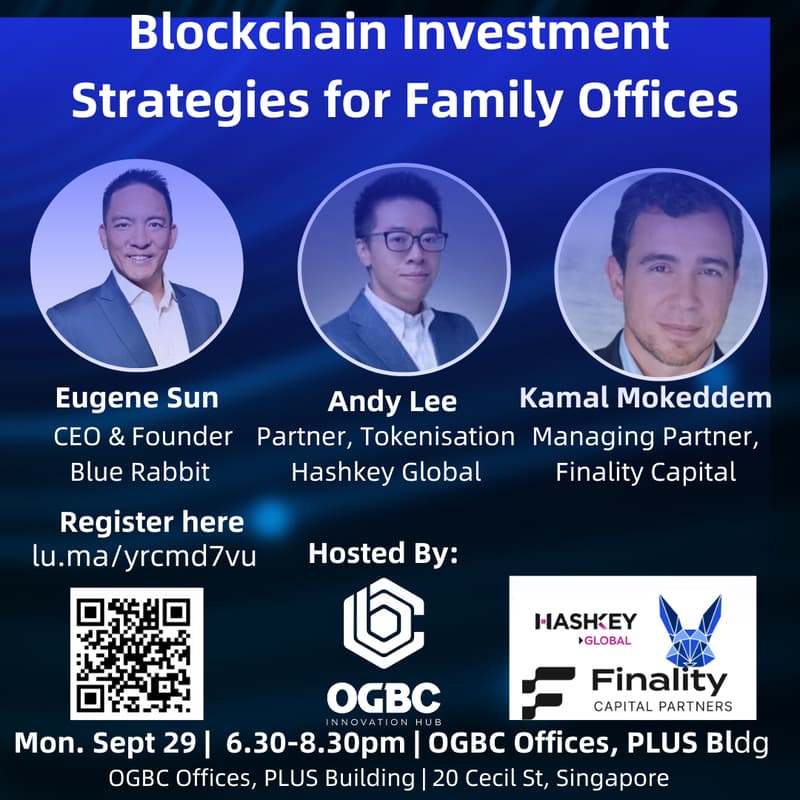

Blockchain investment strategies for family offices and insitutions

Blockchain investment strategies for family offices and insitutions

Date: Mon, Sep 29

Time: 6.30 PM - 10 PM

RSVP: https://luma.com/yrcmd7vu

Format: panel and townhall discussion

Location: 20 Cecil Street #04-07 PLUS, Singapore 049705

Join us for an exploration of unconventional investment strategies, featuring: Blue Rabbit, Hashkey,

-----

HashKey Global / Hashkey Tokenization:

HashKey Group, the parent company of HashKey Exchange, aims to become a key builder of infrastructure in the Asian Web3 digital entertainment ecosystem, contributing to network security and operational efficiency.

HashKey Tokenisation is at the forefront of driving innovation and adoption in the digital asset space, empowering businesses and institutions to unlock the full potential of tokenisation.

As part of our commitment to regulatory compliance and excellence, HBS (Hong Kong) Limited under HashKey Tokenisation holds Type 1 (Dealing in Securities) and Type 4 (Advising on Securities) licences issued by the Securities and Futures Commission (SFC) of Hong Kong.

About the Blue Rabbit:

At Blue Rabbit, our mission is simple yet ambitious: to provide tailored solutions that build, preserve, and grow family wealth using cutting-edge technology. We believe that wealth management shouldn't be a privilege for few—it should be accessible, transparent, and client-centered for everyone. https://bluerabbit.ai/

About Finality Capital:

Finality Capital Partners manages Finality Liquid Opportunities (FLO). The strategy takes a discretionary long-biased directional approach that seeks to outperform global asset classes while managing volatility. FLO uses a multi-strategy approach, investing across a broad universe of publicly traded digital-asset-related traditional securities and blockchain-native assets, leveraging macro and fundamental insights.